Contents

- The Full STP Process

- Step One – Define the market

- Step Two – Create market segments

- Step Three – Evaluate the segments for viability

- Step Four – Construct segment profiles

- Step Five – Evaluate the attractiveness of each segment

- Step Six – Select target market/s

- Step Seven – Develop positioning strategy

- Step Eight – Develop and implement the marketing mix

- Step Nine – Review performance

- FAQs

The Full STP Process

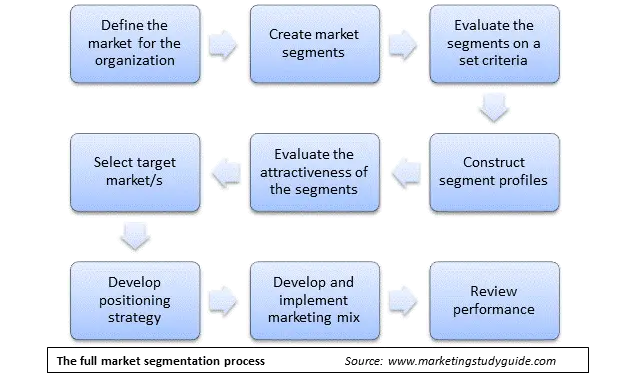

The market segmentation, targeting and positioning (STP) process is a fundamental concept in understanding marketing and the strategies of firms.

There are two primary models of the STP process: the Basic Model, which simplifies the concept into three broad steps (Segmentation, Targeting, and Positioning), and the Full Model, which breaks these steps into nine detailed stages. In most marketing textbooks, the STP approach is presented as a simple three step process. While that approach provides a good introduction to this marketing concept, it fails to adequately highlight the smaller steps of the STP process that should also be understood.

Therefore, it is recommended that the Full Model provides a more comprehensive framework for understanding the STP process. Let’s start with the following diagram highlights the overall STP process in nine steps:

The following is a discussion of the full market segmentation, targeting and positioning (STP) process, as shown above.

Step One – Define the market

In the first step in this more detailed model is to clearly define the market that the firm is interested in. This may sound relatively straightforward but it is an important consideration.

For example, when Coca-Cola looks at market segmentation they would be unlikely to look at the beverage market overall. Instead they would look at what is known as a sub-market (a more product-market definition). A possible market definition that Coca-Cola could use might be diet cola soft drinks in South America. It is this more precise market definition that is segmented, not the overall beverage market, as it is far too generic and has too many diverse market segments.

Step Two – Create market segments

Once the market has been defined, the next step is to segment the market, using a variety of different segmentation bases/variables in order to construct groups of consumer. In other words, allocate the consumers in the defined market to similar groups (based on market needs, behavior or other characteristics).

Common segmentation bases include:

- Demographic variables: Age, gender, income, education.

- Behavioral variables: Purchase frequency, brand loyalty.

- Psychographic variables: Lifestyles, values, interests.

- Geographic variables: Region, climate, or urban/rural differences.

- Benefit segmentation: Specific benefits, such as convenience, quality, or performance.

- Hybrid segmentation: Combining multiple bases, such as psychographics and demographics, to create more detailed segments.

Step Three – Evaluate the segments for viability

After market segments have been developed they are then evaluated using a set criteria to ensure that they are useable and logical. This requires the segments to be assessed against a checklist of factors, such as: are the segments reachable, do they have different groups of needs, are they large enough, and so on.

For example, the criteria can include:

- Measurability: Can the size and purchasing power of the segment be quantified?

- Accessibility: Can the segment be reached through effective communication and distribution channels?

- Substantiality: Is the segment large enough to be profitable?

- Differentiability: Are the needs of this segment distinct from others?

- Actionability: Does the firm have the resources to effectively target this segment?

Step Four – Construct segment profiles

Once viable market segments have been determined, segment profiles are then developed. Segment profiles are detailed descriptions of the consumers in the segments – describing their needs, behaviors, preferences, demographics, shopping styles, and so on. Often a segment is given a descriptive nickname by the organization. This is much in the same way that the age cohorts of Baby Boomers, Generation X and Generation Y have a name.

Segments profiles typically include:

- Demographic information: Age, income, education.

- Behavioral traits: Purchase habits, product preferences.

- Psychographic insights: Lifestyle, values, attitudes.

- Key needs and preferences: What the segment values most in a product or service.

For instance, a profile for a “tech-savvy millennials” segment might highlight their preference for cutting-edge technology, eco-friendly materials, and online purchasing channels. Giving segments descriptive nicknames, like “Budget Betty” or “Eco Ella,” can make them more relatable and easier to communicate internally.

Step Five – Evaluate the attractiveness of each segment

Available market data and consumer research findings are then are added to the description of the segments (the profiles), such as segment size, growth rates, price sensitivity, brand loyalty, and so on. Using this combined information, the firm will then evaluate each market segment on its overall attractiveness.

Some form of scoring model will probably be used for this task, resulting in numerical and qualitative scores for each market segment.

Factors for evaluation in the scoring model could include:

- Market size and growth potential.

- Competitive intensity within the segment.

- Price sensitivity and brand loyalty.

- Profitability of targeting the segment.

Step Six – Select target market/s

With detailed information on each of the segments now available, the firm then decides which ones are the most appropriate ones to be selected as target markets. There are many factors to consider when choosing a target market.

These factors include:

- firm’s strategy,

- the attractiveness of the segment,

- the competitive rivalry of the segment,

- the firm’s ability to successfully compete

- and so on.

For example, a luxury fashion brand might choose to target “affluent urban professionals” who value exclusivity and premium quality, avoiding price-sensitive consumers.

Step Seven – Develop positioning strategy

The next step is to work out how to best compete in the selected target market. Firms need to identify how to position their products/brands in the target market. As it is likely that there are already competitive offerings in the market, the firm needs to work out how they can win market share from established players.

Typically this is achieved by being perceived by consumers as being different, unique, superior, or as providing greater value. For example, Tesla positions its vehicles as innovative, sustainable, and luxurious, appealing to eco-conscious yet status-driven consumers.

Step Eight – Develop and implement the marketing mix

Once a positioning strategy has been developed, the firm moves to implementation. This is the development of a marketing mix that will support the positioning in the marketplace. This requires suitable products need to be designed and developed, at a suitable price, with suitable distribution channels, and an effective promotional program.

Step Nine – Review performance

After a period of time, and on a regular basis, the firm needs to revisit the performance of various products and may review their segmentation process in order to reassess their view of the market and to look for new opportunities.

FAQs

What is the Full STP Process?

- The Full STP Process expands the traditional three-step model (Segmentation, Targeting, and Positioning) into nine detailed stages, offering a comprehensive framework for understanding and implementing marketing strategies.

Why is defining the market important in Step One?

- Defining the market ensures focus on a specific and relevant sub-market. For instance, Coca-Cola segments the market for diet cola soft drinks in South America instead of the entire beverage market, which would be too broad and diverse.

What segmentation bases are used in Step Two?

Segmentation bases include:

- Demographic: Age, gender, income.

- Behavioral: Purchase frequency, brand loyalty.

- Psychographic: Lifestyles, values.

- Geographic: Region, climate.

- Benefit: Desired product benefits like quality or convenience.

- Hybrid: Combining multiple bases for detailed segmentation.

How are segments evaluated for viability in Step Three?

- Segments are assessed using criteria like measurability, accessibility, substantiality, differentiability, and actionability to ensure they are logical and actionable.

What is the purpose of segment profiles in Step Four?

- Segment profiles provide detailed descriptions of consumer groups, including demographics, behaviors, and preferences, helping firms understand and target their segments effectively.

What factors determine segment attractiveness in Step Five?

- Attractiveness is evaluated based on market size, growth potential, competitive intensity, price sensitivity, and profitability, often using a scoring model.

What are key considerations when selecting target markets in Step Six?

- Firms consider their strategy, the attractiveness of the segment, competitive rivalry, and their ability to compete successfully within the segment.

How is positioning established in Step Seven?

- Positioning involves crafting a unique value proposition that differentiates the product, such as Tesla’s positioning as innovative, sustainable, and luxurious.

What is the role of the marketing mix in Step Eight?

- The marketing mix (product, price, place, promotion) is developed to support the chosen positioning strategy, ensuring consistency and effectiveness in the market.

Why is reviewing performance crucial in Step Nine?

- Regular performance reviews ensure the STP strategy remains effective, allowing firms to adapt to changes in market conditions and uncover new opportunities.