Contents

How to construct a perceptual map

The section below highlights how you can construct a perceptual (or a positioning map). However, if you are new to perceptual maps, you may need to review what is a perceptual map first.

If you would like to download a free Excel spreadsheet that will enable you to quickly and easily create your own perceptual maps, then visit www.perceptualmaps.com

Also see instructional VIDEOS below.

Step one – select two determinant attributes

There are two main approaches to constructing a perceptual map. The first is used it is where management of the organization utilizes their collective the knowledge and experience of the market to construct a perceptual map, and the second approach is where you have access to the results of a suitable market research study.

Either way, the first step is to select the determinant attributes. As discussed in the what is a perceptual map topic, determinant attribute are those attributes that the consumer relies upon in their purchase decision. In other words, determinant attributes are quite important to them and the consumer uses them to help differentiate competitive offerings.

As a rough guide, some likely determinant attributes in different product categories are shown in the following table:

| Product Category | Likely Determinant Attributes |

| Shoes | Comfort, design/style, quality, functionality |

| Instant coffee | Flavor/taste, country of origin, variety, quality |

| Breakfast cereal | Healthiness, sugar level, variety, fun/boring factor |

| Holiday destination | Temperature, travel distance, culture difference, facilities |

| Camera | Zoom, memory, size/weight, picture quality |

Note: Price is not shown in the above table. While price is a cue for quality and certainly does affect the perceptions of a brand/product, it is generally not helpful when constructing a perceptual map. You may use quality instead of price – but never use price and quality in the same map as they are high correlated and the map’s outcome will be poor.

Depending upon the product category, we need to consider how consumers choose the product between offerings. Take the shoe category; most consumers would select shoes on the attributes listed in the above table. While that list may not be valid for every single consumer, we are simply trying to get an understanding of the target market overall, so some generalization is fine.

From the list of possible determinant attributes (that may be given to you or you may need to develop based on your best judgment), you need to select two only. These two will form the axes of your perceptual map. Try and pick the two that you think would be the most important in terms of the product choice between competitive offerings.

Step two – list the main competitors in the product category

For whatever product category you are looking at, you will need to compile a list of the main competitive brands/products. These are the brands that will be plotted upon on to your perceptual map. You don’t need to list every single competitor in the marketplace, but you should try for a list of five to ten players.

Note that the term ‘brands/products’ has been used. This is because sometimes there are multiple products under the same brand. For example in the cereal market, Kellogg’s is the main family brand name, and they run a number of individual brand names will such as Kellogg’s Corn Flakes, and they also may have product line extensions (that is, different varieties of Corn Flakes). So depending upon the task, you may need to drill down deeper if required.

Step three – Create scores for these brands

Now we have our have chosen the brands, we need to allocate scores for them using the two determinant attributes. The simplest way to do this is by using simple 1 to 5 rating scale.

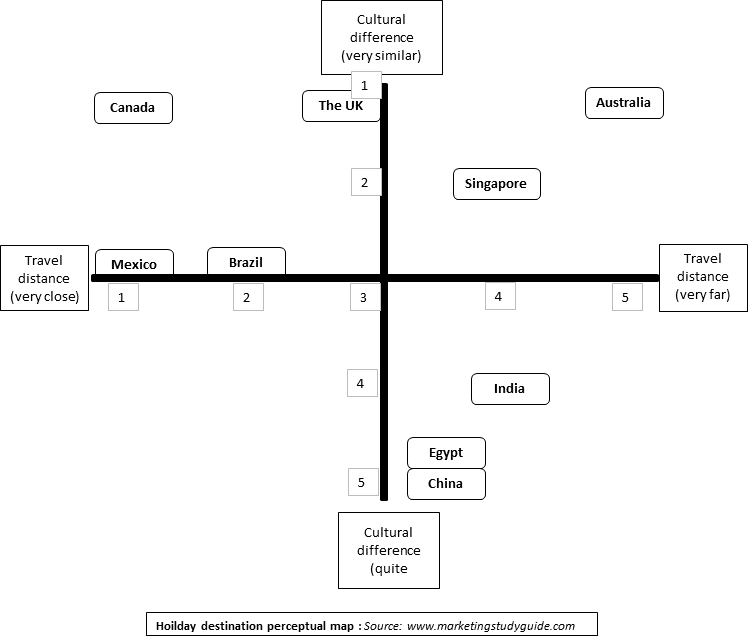

Let’s look at an example in the following table. This example uses the holiday with two of the determinant attributes listed category (from the above table). Note how a 1 to 5 polarized (opposite) scale has been used. The scores are a good estimate of how an average American traveler (the assumed target market in this case) would perceive these possible holiday destinations/countries.

|

Holidays |

Travel distance 1 = very close, 5 = very far |

Culture difference 1 = very similar, 5 = quite different |

|

Mexico |

1 |

3 |

|

Canada |

1 |

1 |

|

The UK |

3 |

1 |

|

India |

4 |

4 |

|

Singapore |

4 |

2 |

|

Australia |

5 |

1 |

|

Egypt |

3 |

5 |

|

Brazil |

2 |

3 |

|

China |

3 |

5 |

Note: Obviously, if you have been given the relevant data or access to a market research study, then you don’t have to estimate the figures in the above table; you can use the real data instead.

Instructional VIDEOS on how to make a Perceptual Map

Perceptual Map Design Considerations and Key Terms

- Purpose of Perceptual Maps

Perceptual maps are powerful tools for visualizing how consumers perceive brands and products in a market. They help identify gaps, track positioning over time, and understand competitive dynamics. - Determining Attributes

Selecting the right attributes is crucial. Use consumer input through surveys or focus groups to identify features that influence buying decisions. Functional (e.g., quality) and emotional (e.g., brand prestige) attributes often matter. - Types of Perceptual Maps

Besides simple two-attribute maps, advanced techniques like multidimensional scaling allow visualization of multiple attributes. Joint maps integrate consumer preferences for a more strategic view. - Use of Statistical Tools

Tools like SPSS and Excel simplify the creation of perceptual maps. These tools are especially useful for handling complex data, such as mapping multiple attributes or analyzing large datasets. - Consumer-Centric Approach

Always build maps with the consumer in mind. Understand how they perceive the product’s attributes and competitors, as this determines your map’s relevance and accuracy. - Case Studies

Real-world examples show how maps are applied across industries like FMCG or electronics. For instance, a soft drink company may map perceptions of sweetness and caffeine content to understand market positioning. - Best Practices

Regularly update perceptual maps to reflect changes in consumer behavior or market trends. Ensure clarity by focusing on key attributes and competitors without overcomplicating the map. - Pitfalls to Avoid

Avoid irrelevant attributes that don’t drive consumer decisions. Also, ensure your data sources are robust and not based solely on management assumptions, which can lead to skewed results. - Linking Maps to Strategy

Perceptual maps are not just analytical tools—they inform decisions on product development, pricing, promotions, and targeting. Use them to align your strategy with market dynamics. - Role in Repositioning

If your product’s position is crowded or ineffective, use perceptual maps to explore new, viable positions. This can be critical for reviving underperforming brands. - Data Validation

Cross-check perception data with actual sales or market share trends. This ensures your conclusions are grounded in reality and actionable. - Interpreting Gaps

Not all gaps on a map represent opportunities. Analyze whether a gap reflects unmet demand or simply an area with no market potential due to lack of consumer interest. - Visualization Tips

Use clear symbols, contrasting colors, and proper spacing to ensure your map communicates effectively. A clean, simple design enhances understanding. - Competitive Reaction

Perceptual maps help anticipate competitor strategies. If a competitor moves into a gap you’ve identified, your map can guide preemptive responses or strategic adjustments.